Not a week goes by without someone asking me what is going on with the local real estate market. Between news articles, social media posts, and awareness of homes sitting with signs in the front yard much longer than they have (not to mention the prevalent price reductions), people are curious.

Many sources are still claiming that we are in an appreciating market. Home-Value-Appreciation means that the property’s value is increasing, or appreciating, over a period of time.

But how can this be? If you’ve seen or heard of the significant amount of price reductions of current housing inventory, you might wonder how we could possibly still be in an appreciating market. Many questions I get reference a depreciating, or declining in value, housing market. Could we have both? The simple answer is yes, let me explain:

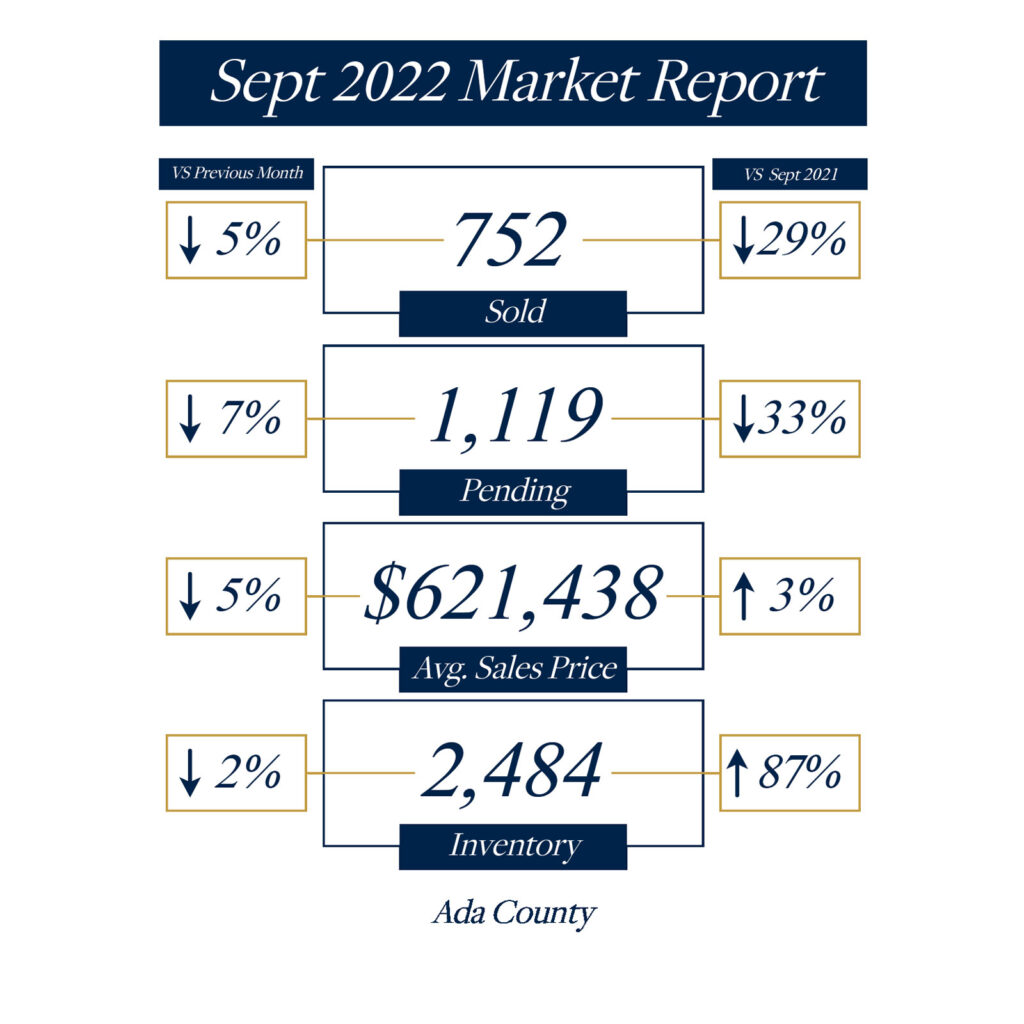

In September, the average sales price in Ada County was $621,438. This is an increase over last September by 3%. So, year-over-year, housing prices have increased 3%. However, this average sales price is down 5% from the previous month. This means that we are depreciating month-to-month.

There are many possible factors contributing to this month-over-month decrease.

-

- Increased inventory – up 87% over last year

- Interest rates increasing – buyers lose ability to qualify / reduce buying power

- Loss of buyer confidence in the economy

- Buyers fatigue of hearing about an inflated housing market

Just to name a few.

It is possible the scale will tip and we will see a depreciation month-to-month and year-over-year. Only time will tell.

We continue to monitor the activity to help both Buyers and Sellers navigate a rapidly changing real estate environment.